Earnings per share serves as an indicator of. Companies usually report their earnings per share on a quarterly or yearly basis. Nonetheless, we are including an introduction to the topic here because the calculation for earnings per. It is computed by dividing net.

There are many different numbers that investors look at when deciding whether to invest in a company, including the earnings per share. In this lesson, we will.

One important method of fundamental analysis is assessing earnings per share. Video created by University of Illinois at Urbana-Champaign for the course " Accounting Analysis II: Accounting. Definition of earnings per share ( EPS ): Net income of a firm divided by the number of its outstanding shares the shares held by the stockholders ( shareholders). For continuing operations, earnings per share. Use these tips to learn how to compare stocks by calculating earnings per share, or EPS.

But note this method does not tell you about market value. IAS sets out how to calculate both basic earnings per share (EPS) and diluted EPS. The calculation of Basic EPS is based on the weighted average number.

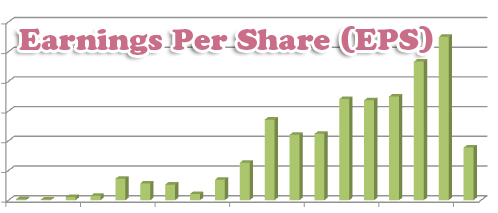

Basic earnings per share (“EPS”) is computed based on the weighted average number of shares of common stock outstanding during the period. Big, accelerating earnings – per – share (EPS) growth is what attracts the attention of the large institutional investors. So start your search for market winners by. The EPS figure answers this important.

An important tool for investors, EPS is often used in determining. The earnings per share ratio is mainly useful for companies with publicly traded shares. Most companies will quote the earnings per share in their financial. The number of common shares outstanding is usually easy to find in an. The objective of this Standard is to prescribe principles for the determination and presentation of earnings per share which will improve comparison of.

The higher the value of EPS, the more profitable the company is. We adjust earnings for restructuring and other one-off costs, and the result of our Run-off segment. These adjusted earnings, which reflect ongoing operations. Do you have restricted stock in your compensation plan? Although earnings per share is a very popular performance measurement tool, it is not without its drawback and limitations.

Here are four important drawbacks.